Is DST Right for You?

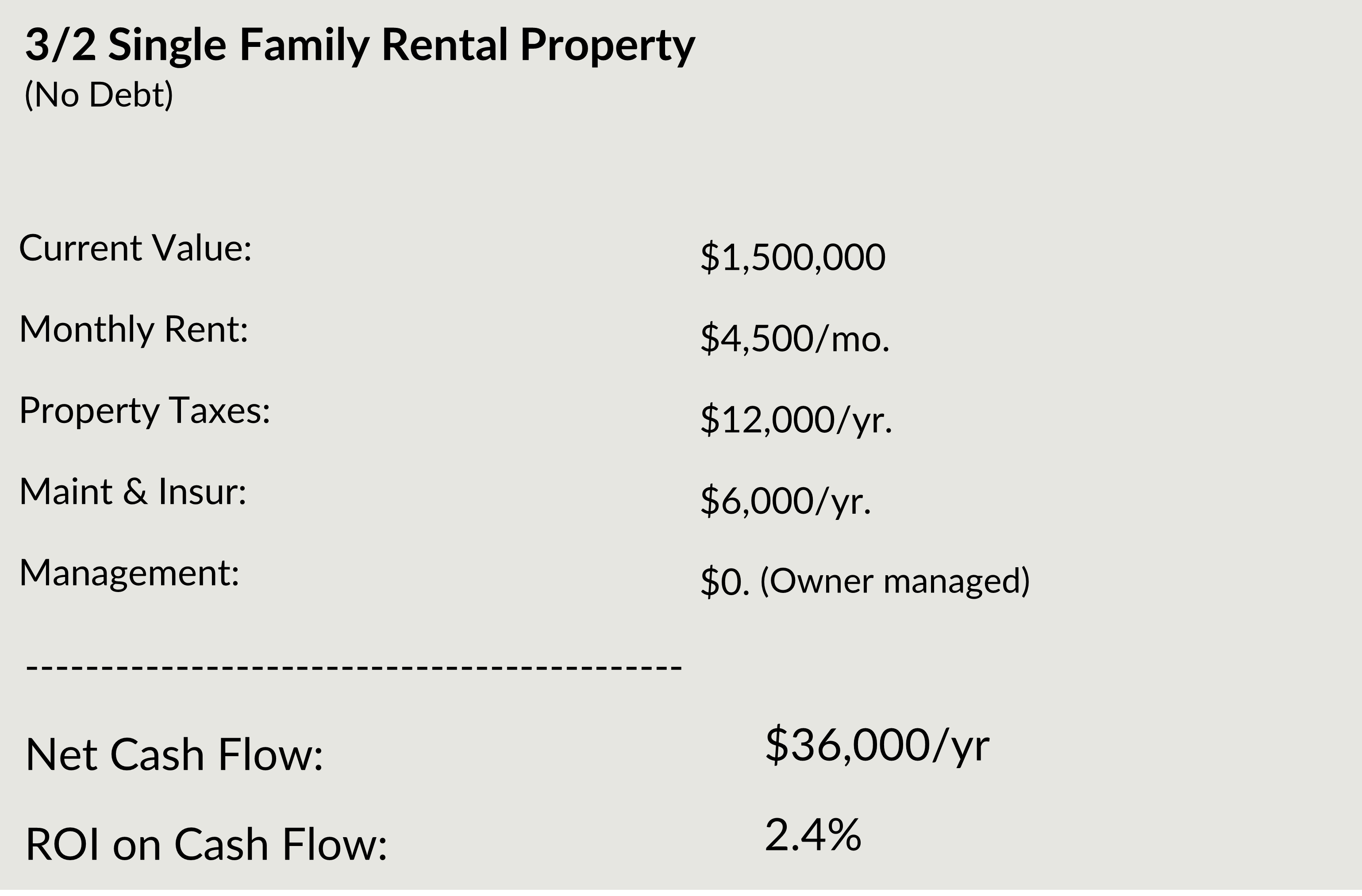

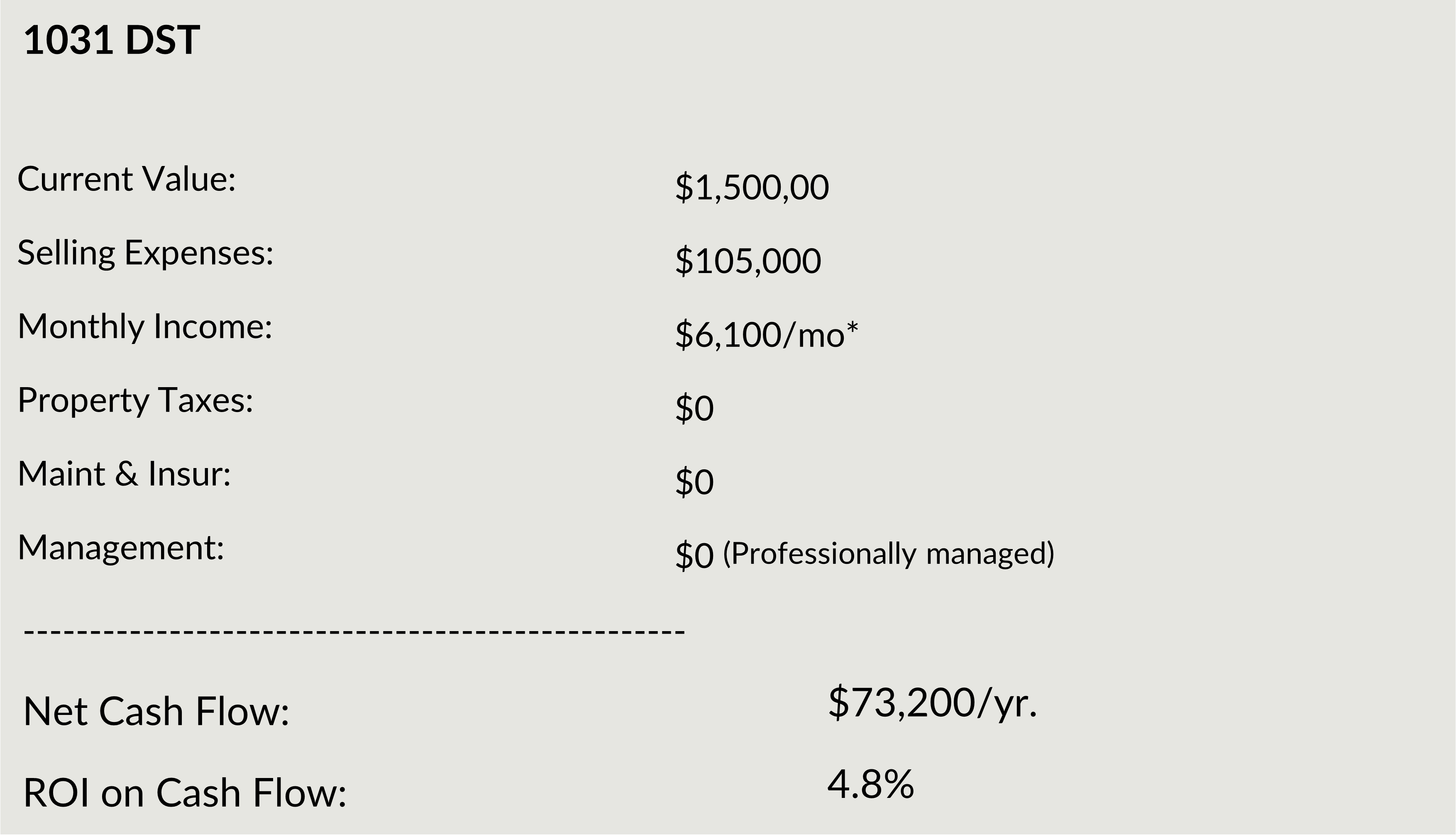

Want to increase your rental income and remove the management burden of your rental properties? Property values have skyrocketed. Have your rents kept up with value increases?

Let Peak 360 Wealth Management show you the possible upside of selling your rental property and doing a Capital Gains Tax-Deferred 1031 exchange into a professionally managed DST property.

Why consider a 1031 DST Exchange?

- No Management Responsibilities

- Access to Institutional-Quality Property

- Limited Personal Liability

- Diversification

- Estate Planning

- Potential for Greater Income

What is a 1031 exchange?

Section 1031 of the Internal Revenue Code provides an effective strategy for deferring capital gains tax that may arise from the sale of an investment property. A 1031 exchange allows property owners to sell investment property and exchange for “like-kind” real estate.

What is a DST?

A Delaware Statutory Trust permits fractional ownership where multiple investors can share ownership in a single property or a portfolio of properties which qualifies as replacement property as part of an investor’s 1031 exchange transaction.

What do DST’s invest in?

Larger real estate projects like Multi-Tenant Housing, Student Housing Projects, Hospitals, Distribution Centers, Self-Storage Facilities, Commercial Real-Estate projects….

Are Capital Gains Eliminated?

No. The Capital Gains are deferred until you sell out of the partnership. The DST structure does allow investors to continue to exchange real properties over and over again until the investor’s death. Under current tax code, the investment would receive a step-up in cost basis so your heirs will not inherit capital gains liabilities.

* Sales proceeds diversified into 2 DST projects. 50% into Capital Square Medical Office DST in Yuma, AZ and 50% in Exchange Right Net Lease 54 DST anchored by CVS, multiple US locations from April 2022.

Securities offered through Lion Street Financial, LLC. (LSF), member FINRA & SIPC. Investment Advisory Services offered through Lion Street Advisors, LLC. LSF is not affiliated with Peak360 Wealth Management, LLC. There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potential adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, returns and appreciation are not guaranteed. IRC Section 1031 is a complex tax concept; consult your legal or tax professional regarding the specifics of your situation. This is not a solicitation or an offer to sell any securities. DST 1031 properties are only available to accredited investors (typically have a $1 million net worth excluding primary residence or $200,000 income individually/$300,000 jointly of the last three years) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney.